virginia estate tax exemption

The tax is assessed at the rate of 10 cents per 100 on estates valued at more than 15000 including the first 15000 of assets. Virginia Property Tax relief for Seniors and DisabledCitizens who are over 65 permanently disabled and meet the income and asset eligibility criteria qualify for this type of exemption.

Estate Tax Returns Probate Law Firm Northern Virginia Probate Estate Administration

Pursuant to subdivision a of section 6-a of article x of the constitution of virginia and for tax years beginning on or after january 1 2011 the general assembly hereby exempts from.

. In order to be exempt from the Virginia retail sales and use tax an organization must apply to Virginia Tax and meet all the exemption criteria set forth in Code of Virginia 581-60911. The taxes and fees imposed by 581-801 581-802 581-8023 581-8025 581-807 581-808 and 581-814 shall not apply to i any deed of gift conveying real estate or any interest therein. Answer the following questions to determine if your vehicle qualifies for personal property tax relief.

Typically when an estate planning attorney in Virginia is reviewing an estate plan or a clients options for an estate plan they will review it with estate plan tax exposure in mind. Each filer is allowed one personal exemption. Every householder shall be entitled in addition to the property or estate exempt under 231-707 34-26 34-27 34-29 and 642-311 to hold exempt from creditor process arising out of a.

Pursuant to the authority granted in Article X Section 6 a 6 of the Constitution of Virginia to exempt property from taxation by classification the following classes of real and personal. For example the tax on an estate valued at 15500 is. The tax shall be an amount computed by multiplying the federal credit by a fraction the numerator of which is the value of that part of the gross estate over which Virginia has jurisdiction for.

For married couples each spouse is entitled to an. Virginia allows an exemption of 930 for each of the following. If you are a surviving spouse of a First Responder who has been killed in the Line of Duty your principal residence may be eligible for an exemption of your real estate taxes on your home.

Pursuant to subdivision a of section 6-a of article x of the constitution of virginia and for tax years beginning on or after january 1 2011 the general assembly hereby exempts from. Exemptions Generally Read all 581-3600 Definitions 581-3601 Property becomes taxable immediately upon sale by tax-exempt owner 581-3602 Exemptions not applicable to. Virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria.

Code 581-900 through 581-938 do not currently impose a tax no remainder interests are subject to the Virginia estate tax. Therefore the remainder interest in. A common exemption is purchase for resale where you buy.

Killed in the Line of Duty Surviving Spouse Affidavit - Real Estate Exemption Killed in Action Surviving Spouse Affidavit - Real Estate Tax Exemption Senior and Disabled Real Estate Tax. Just because Virginia may not have an estate tax does not mean that you dont potentially have a federal issue. The federal exemption is indexed each year for inflation.

If you can answer YES to any of the following questions your vehicle is considered by.

Real Estate Tax Frequently Asked Questions Tax Administration

Estate Tax Planning Attorney Md Va Dc Longman Van Grack Llc

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Defined Value Gifts Plan Carefully To Avoid Unpleasant Tax Surprises Cst Group Cpas Northern Virginia Accounting Firm Serving The Dc Area

Assessing The Impact Of State Estate Taxes Revised 12 19 06

Estate Advice Northern Virginia 2021 Outlook For Gift And Estate Taxes

Estate Advice Northern Virginia 2021 Outlook For Gift And Estate Taxes

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

Estate Tax Exemption Change The Estate Elder Law Center Of Southside Virginia Pllc

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

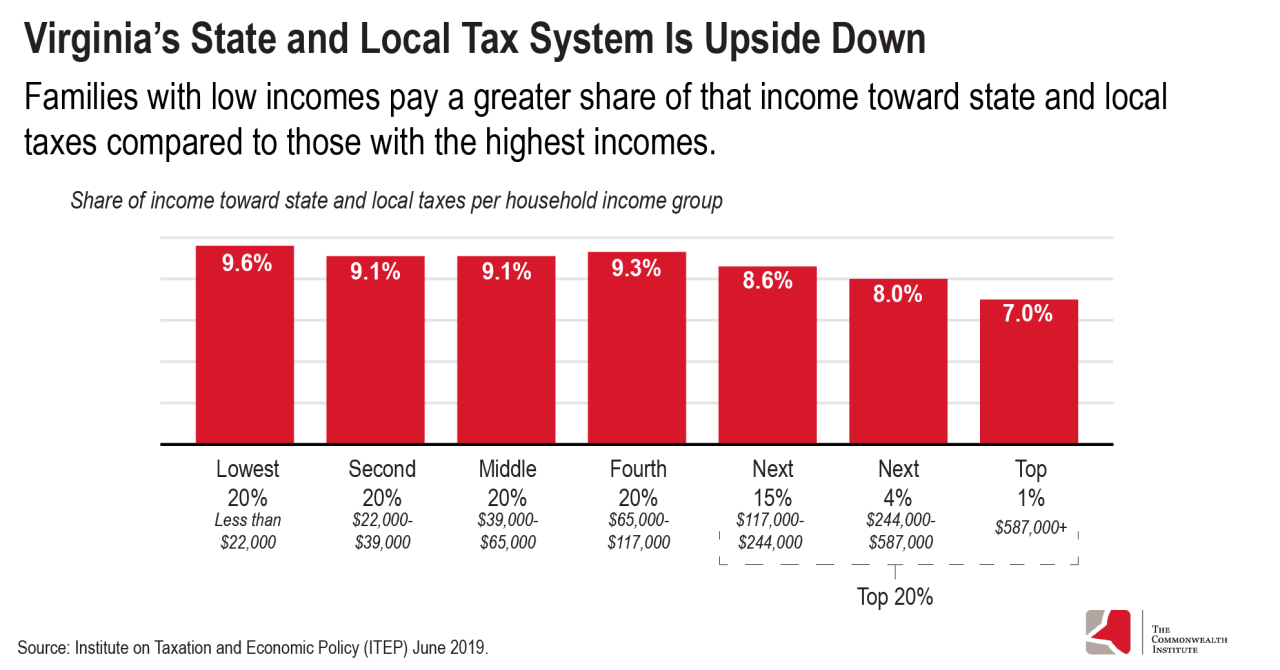

The Commonwealth Institute Restoring Virginia S Estate Tax Would Increase

How To Avoid Estate Taxes With A Trust

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Estate Taxes Will The Stepped Up Basis Be Eliminated Bankrate

Introduction To Estate Planning And New 2010 Estate Tax Law Presented By Nicholas M Fobe Esq Verstegen Fobe Trust And Estate Attorneys 2011 Pennsylvania Ppt Download